It's hard not to think of economics without first thinking of Robert Nadeau (http://www.scientificamerican.com) pointing to the vast edifice of so-called economic science and crying out, “Emperor! Naked!” Even today it seems as if that most mysterious of mysteries — cloaked as it is by an impressive dictionary of words like collaterized debt obligations, capital gains tax and hedge funds — offers little improvement over past economists’ strategy of substituting economic variables in equations repurposed from obsolete theories of physics. But if the foggy science itself is bewildering, what are we to make of it when seen through the distorting lenses of politics and the media? Throw in ideology, reduced to the eternal and immature struggle between conservatives and liberals, and the result is a bloody nose for spectators.

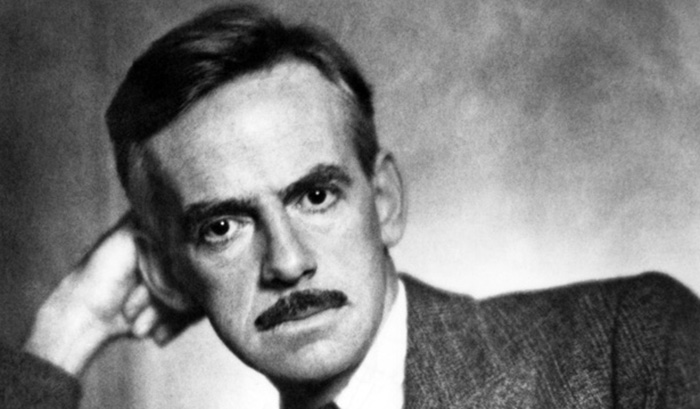

[img]1080|left|||no_popup[/img]Into the fray comes Paul Christopherson, an ordained Episcopal priest and former Wall Street analyst, with an attempt to mount a rescue of us beleaguered cogs in the machine. Titled Pants on Fire: Cutting Through the Biggest Lies of Twenty-First Century American Plutocracy, Christopherson's appealing tract presents seven lies that, in his view, sustain a political and economic system subservient to the country's wealthy elites.

At an almost anorexic 101 pages in length, Christopherson does not get into great detail about these lies, which include trickle-down economics, the notion that deregulation is good, and that it was necessary to bail out Wall Street to preserve the system. He does, however, sketch out arguments that orbit the thesis of corporations turned against themselves as the real American economy is subverted by the shadow economy of Wall Street.The crux of this plutocratic operation rests in the lie of trickle-down, which is more commonly known as voodoo economics or, of course, Reagonomics. Christopherson writes:

“The tax cut on dividends was supposed to incentivize higher payouts, while the cap gains cut was supposed to stimulate business investment. This was an obvious contradiction. Even if one grants the efficacy of tax incentives (for which there is little historical evidence), they were clearly not operable here since the two impulses being stimulated are mutual exclusive and would logically cancel out each other. If business investment grows, then liquidation, which is what dividends are, must slow down, and vice versa; incentivizing both capital gains and dividends together is not logically possible. And in the event, following the tax cuts, business investment collapsed and dividends have been partly replaced with share repurchases.”

To parse into plainer English, an activity Christopherson could occasionally benefit from, tax cuts on both dividends and capital gains, the providence of those wealthy enough to invest in corporations, encourage a weird kind of self-cannibalism. Tax cuts on capital gains, which come from an increase in value of a corporation’s capital assets, encourage investment. Dividends, which are merely payouts from the profits, are, as Christopherson points out, a liquidation — a net subtraction, in other words. Since most people don’t derive income from dividends and capital assets, the tax cuts are the sort of stimulus that don’t really accomplish the stimulation they are intended do. But Christopherson argues that the situation is worse than that. Corporations have become so indentured to maximizing shareholder profit that a conflict of interest has been created between the interests of the company and shareholder interests. Expanded to account for executive compensation, tied to share options and the like, along with deregulation that allows Wall Street to become Wild Street, the overall result is a system rigged to make money by the only people who can use the system; people who already have money. When Christopherson points out that the system provides a disconnect between the real economy as we understand it — rooted in tangibles like labour — and the Wall Street casino of stock markets, joined with the banks’ creation of exotic and toxic financial instruments, and we are not only made to be the suckers of the TARP bailout, but the victims of a long con.

As much as the conclusions can be persuasive and generally accessible — reading the book is much like having a coffee table chat with a friend who happens to have worked for firms like Bear Stearns — Pants on Fire falls victim to a rhetorical sin of wishy-washy statement of sources. Apart from a few books that informed his discussion of agriculture and references made in passing throughout the text, he simply lists The New York Times and internet searches as his sources. Compared to the fact-citing vigour taken by the economic opposition, such as the authors of The Young Conservative’s Field Guide, Christopherson’s lack of rigour has an unnecessary, dilutive effect on his arguments’ credibility.

To Plumb a Little Deeper

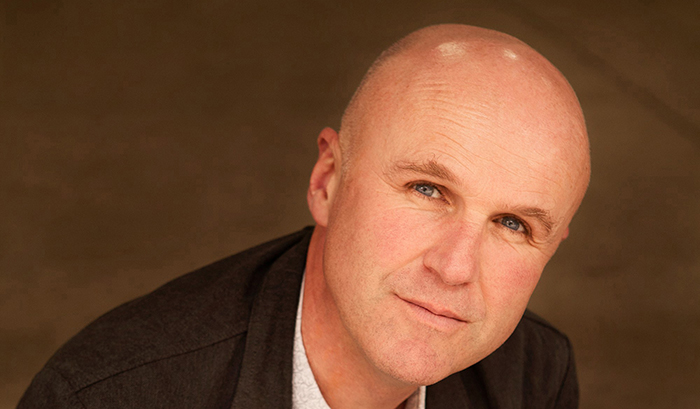

[img]1081|left|||no_popup[/img]Compare Pants on Fire, then, with senior Alternet writer and editor Joshua Holland’s heftier The 15 Biggest Lies About the Economy, and Everything Else the Right Doesn’t Want You to Know About Taxes, Jobs, and Corporate America. Addressing the same issues as Christopherson but expanded to other misconceptions about the economy (lies, if you will) within the greater context of partisan brinkmanship, Holland provides a journalistic-level argument against the economic bromides spread by politicians and the corporate media. These include the glory of free trade, the superiority of American healthcare, and the notion that the American Dream is alive and well instead of bleeding to death in a dark, smelly alley behind Congress.

Holland goes further, however, by shedding Christopherson’s studied distance from the partisan fray by directly naming and confronting ideological conservatism. Whether it’s the Laffer Curve, the amount of taxes paid by the various economic classes, or any number of arguments and data cited by conservatives, Holland’s rebuttal demonstrates its muscularity by not relying solely on solid, clearly reasoned rhetoric, but also drawing on thoughtful considerations rooted in how people really live and work. The result is a factual counterpunch to conservatives’ methodological cherrypicking of the kind offered by The Young Conservatives’ Field Guide, the Republican Party and others. Pragmatists will scoff at the ideological stance of the book, but the truth is that a line has been drawn between different economic perspectives. After roughly 30 years of conservative or conservative-light economic policies, even throughout the Clinton years, Holland doesn’t simply present general objections to the current plutocracy as Christopherson does, but a well-rounded discussion that lays out and clarifies a progressive alternative. In this, while the book’s title may imply a focus on the choir, Holland is more interested in moving beyond the bumper stickers and talk-show caricatures. For conservatives, the book provides a look at what progressives really think. For progressive, the book offers refined arguments and informational support.

In choosing between Pants on Fire and The 15 Biggest Lies About the Economy, it is with some irony that the choice boils down to simple economic one: pay $12.95 for a thoughtful op-ed piece (or $9.99 for an eBook), or get the equivalent of an investigative report for a few dollars more.

****

Pants on Fire, Cutting Through the Biggest Lies of Twenty-First Century American Plutocracy, by Paul Christopherson, is available at iUniverse: http://www.iuniverse.com/Bookstore/

The 15 Biggest Lies About the Economy, and Everything Else the Right Doesn’t Want You to Know About Taxes, by Joshua Holland, is available in bookstores and online booksellers.

Mr. Sisa is Assistant Editor of www.thefrontpageonline.com

eMail: fsisa@thefrontpageonline.com

blog: www.inkandashes.net

…and also fashion with TFPO's The Fashionoclast at www.fashionoclast.com